TABLE OF CONTENTS

‘High-risk’ Ethereum Dapp Volume Rises Two,853%, the new Report Claims that Ethereum has taken a transparent lead within the class over the last year, however, the risks are real.

High-risk Ethereum Dapp Volume Rises Two,853%, New Report Claims In Brief

DappRadar reports that “high-risk” Ethereum dapp usage has surged year-over-year.

Just a number of standard apps sometimes drive a lot of the activity.

Ethereum dapp HEX presently commands a majority of the class volume.

There’s been an associate degree explosion of growth in ‘high-risk’ decentralized apps over the past year, particularly on the Ethereum blockchain, per a brand new report from knowledge analytics web site DappRadar.

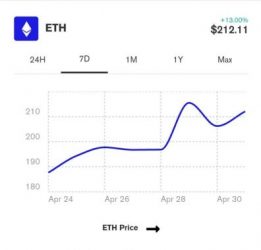

According to the site’s knowledge, speculative Ethereum class volume within the half-moon of two020 surged 2,853% year-over-year compared to Q1 2019—from $0.85M to $25M—and by 948% in terms of daily active wallets.

ETH Price

What constitutes a “high-risk” dapp? DappRadar Communications Director Jon Jordan told decode that whereas there’s some overlap with gambling dapps — a separate category—the speculative designation suggests a distinct reasonably interactive expertise that will not forever totally state its risks and rules.

“The formal definition of being ‘high-risk’ is additionally one that recognizes that the kind of merchandise you’ll devolve on blockchains are terribly totally different to centralized gambling apps, so unambiguously thus once it involves the creation and transference of economic worth,” aforesaid Jordan.

Earn tokens & rewards with our mobile app.

Get early access to our app to earn decode Token, redeemable prizes, and far additional.

The Ethereum Dapp App

The data conjointly represents a dramatic shift within the lead protocol for speculative apps. TRON had been the clear leader in Q1 2019, with Ethereum representing solely a small sliver of the entire volume at the time. In Q1 2020, the stats had reversed, with TRON relegated to a really tiny portion of what was a bigger overall total class. Eos conjointly lost important ground to Ethereum throughout that span and isn’t even visible on DappRadar’s chart over the last 2 quarters.

“Most common are speculative dapps that invoke some sort of hot potato/game theory within which users pay their tokens into a prize pot and one user walks off with the complete pot either by chance or by a mix of luck, smarts/use of bots, etc,” Jordan aforesaid. “Of course, if this setup/conclusion is formed terribly clear to everybody at the beginning, its fine, however, it is not forever the case.”

DappRadar’s knowledge suggests that a lot of those speculative dapps go bad quickly. The class is that the second-largest on the location, however solely Bastille Day of the 724 listed dapps are still active.

Ethereum DeFi comes Grew Nearly 800% Over the last year: report

Despite the chaos within the markets over the last many months, 2019 was a decent year for decentralized applications (dapps)—and particularly for the rising DeFi sector. A brand new report issued by a…

Coins

A handful of particularly standard apps are inflating the general class volume, like the disputable HEX, associate degree Ethereum dapp that’s represented as “the initial high-interest blockchain CD.” HEX alone commanded sixty-fourth of the class volume for Q1 2020. DappRadar is sharing extra analysis into HEX within the close to future.

Even with the “high-risk” designator hooked up to such dapps, it hasn’t stopped the degree and users from billowy. Still, the interrogation point lingers around the class, and Jordan aforesaid that past samples of fraud or enigmatically missing token pots have helped bitter perceptions concerning the legitimacy of dapps.

“Such speculative dapps have bolstered notions concerning blockchains encouraging at the best scammy, at the worst illegal behaviors,” he said.

How can High-risk Ethereum Dapp Volume Rise Have an Effect on Bitcoin?

While the acute rate at that states are printing cash to counter the economic impact of the pandemic may be regarded within the long run, some specialists believe that government and financial institution stimuli are literally “good for Bitcoin,” particularly because the next mining reward halving is simply round the corner.

RELATED ARTICLES

- Zebpay.com; Buy; Sell Bitcoin In India

- Local Bitcoin Purchased | Buy Bitcoin At Bitcoin Stock

- Luno Blockchain Wallet App: App That Lets You Buy | Sell Bitcoin | Etherum

- Cryptocurrency Discovery | Best Cryptocurrency, Bitcoin; Blockchain Books

“As things stand, we have a tendency to are in line to post a decennium rise for Bitcoin since the lows of December 2018, and therefore the surge we have a tendency to ar presently seeing paints an optimistic image for the months following this third halving,” Joshua Mahony, a senior analyst at UK-based derivatives mercantilism company immune serum globulin cluster.

The number of people exploitation apps that integrate Ethereum’s blockchain technology is on the rise, per an innovative report.

In 2019, an entire of 1.28 million new users engaged with suburbanized apps (DApps) built on Ethereum, per Dapps.com, with 128,000 returning users.

The report, in addition, highlights sharp growth at intervals the vary of people exploitation suburbanized financial services built on the Ethereum network.

SEE; Buy Bitcoin Debit Card | How to Buy Bitcoin With Debit Card

“Nearly 1/2 active Ethereum dapp users have used DeFi dapps in 2019. seventieth of the degree generated by the native ETH token was the employment of suburbanized exchanges and financial services, like disposition and etc.”

Overall, gambling applications still be the foremost common use for suburbanized apps, with over 900 new apps built for gambling and various “high risk” applications.

According to the report, the great contract platform Tron presently has the second-biggest DApp theme behind Ethereum in terms of the number of applications and overall active users. Greek deity had the easiest vary of active users until the Gregorian calendar month, once the number plummeted by quite eightieth.

Also, read- Remitano; Withdraw Bitcoin into Bank account Instantly; Worldwide

As for gambling applications – a highly-touted early use case for DApps – the report says Ethereum is that the prime choice for developers. Quite 2 hundred thousand users engaged with Ethereum gambling DApps last year, that’s doubly as many as Tron and Greek deity combined.